What Is Peer-To-Peer Lending (P2P) And How It Works?

Peer to peer lending became very common in recent years, thanks to the development of IT. Experts estimate the potential of this type of financing in trillions of dollars in the near future. However, what does P2P lending represent? If you want to know in promising advanced financing methods, then read on to find out how it works.

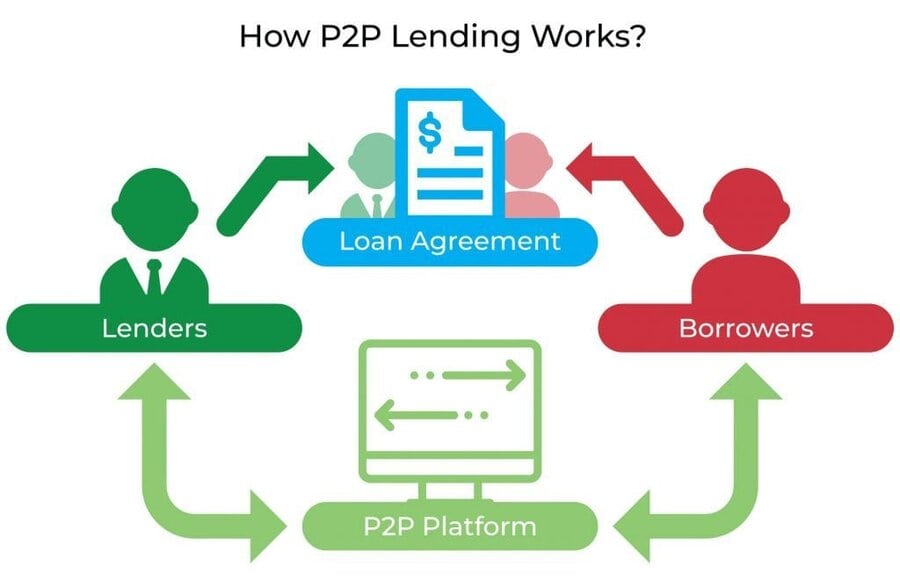

Peer-to-peer lending represents a type of crowdfunding. Unlike a bank, here loans are issued by various persons as a lender, the same as the borrower is. The intervention of third parties does not occur, because lenders and borrowers as agreement parties interact direct between each other. The lending process happen almost as much as you borrow a small sum from a friend.

About lending

Any lending is the provision of funds for a specific time for earning the interest, in contempt of who is the lender. Borrower returns money to the lender, usually by way of equal monthly instalments.

In any case, the borrower pays more money than he initially takes, at the expense of the interest, at which the creditor earns and compensates for his risks. The annual percentage rate will vary significantly, relying on the type of credit, the creditworthiness of the borrower, its history of the borrowing and other credit characteristics.

Peer financing

In case of thus lending, everything is practically the same, as in other types, except the creditor. The borrower does not borrow funds from a bank or some kind of financing company, but from individuals like himself. Money for one credit sum with peer to peer lending can lend by many creditors at once.

If you are a borrower, then you will also have to make instalments until you close the debt, as with other credit types. It seems to be few peer to peer lending differences from other types, but it has its own advantages, which make people turn to it more and more.

Advantages of P2P lending

Peer-to-peer borrowings frequently suggest more interesting terms and APR than most of defferent types of loans. Interest may vary, so when you intend to borrow money through peer to peer lending, first make sure you clear understand the credit terms and the interest of involved creditors.

P2P borrowing offers better conditions due to the fact that lenders do not need to maintain a large infrastructure, like banks or large credit companies. All that is needed is a website as a place for peer to peer lending perties, where the borrower can find demanded credit.

Due to this, peer-to-peer lending creates strong competition to large credit institutions, therefore, its prospects are evaluated so highly.

The impact of peer to peer lending on your credit

Credit rating likewise will change relying on how you handle your peer to peer credit. With timely payments, your credit will improve. Your credit report consists of data on all your loans both that were in the past and that you have now. It reflects all repayment, arrears as well as both the number of borrowings and their sums.

Using information from the borrower’s credit report, creditors make a decision about approving your loan and determining its terms. Therefore, peer to peer lending can increase your financial capabilities in the future.

Earn at peer-to-peer lending

In case you have a certain amount of free funds and you are interested in to invest it, then peer to peer lending can be a worthy variant for this. This type of investment is becoming increasingly popular among many small investors.

Peer to peer lending does not require large expenses and investments; you can lend small amounts through a special web platform. Rates on such loans will allow you to earn in such a way significantly more than on a bank deposit, the interest from which usually covers only monetary inflation.

Money security

Like any type of lending, peer to peer lending also bears risks for the creditor by reason of that there is always a chance that the borrower will not be able to pay off the loan. This type of loan reduces such risks through diversification.

The website by means of which peer to peer lending occurs distributes your investments among various borrowers. This decreases the risk of non-payment compared to if you lend the full amount of your investment to one person. Even if some of your borrowers do not pay their debt, you will lose only a small portion of the money, but not the entire amount.

In addition, many lenders create pools in which they save money in case of non-payment by the borrowers. As you can see there are risks, but it is also true that there is no risk-free type of investment.

What is Peer-to-peer lending for the borrower

Peer financing is a fairly convenient way to lend money. With the help of a P2P lending platform, you make a loan application while you are at your convenience. There is no need to visit personally any office or bank.

Depending on the condition of your credit, you will receive approval or waiver, a high or low interest rate, and other conditions that lenders will establish. From several hours to several days, lenders will review your loan application and verify your details before deciding.

What is Peer-to-peer lending for lenders

Wanting to invest your money in peer financing, you transfer a certain amount to the account of the web platform. Then, in response to a request from borrowers, the platform consolidates the money of different lenders in order to accumulate the necessary amount.

Until the loan is issued, your money will not start working. When a borrower repays you a loan, your money also stops working until it is issued as a loan again. If the borrower pays out ahead of time, then you will lose part of your earnings, as the interest rate will stop charging.

If you are a new investor on some platforms you may have to wait until your money starts working, since in most cases reinvestment of those already working money takes precedence over new investments.

Need a quick loan?

Peer-to-peer lending provides excellent opportunities for both borrowers and lenders. However, not everyone may have access to peer to peer loans due to bad credit or because of the urgency, when money is needed very quickly.