What Are The Preparations For Personal Loans? Few Steps To Take In 2020

Few steps to take in order to get a guaranteed personal loan

If you want to obtain guaranteed personal loan, you have to be aware of certain conditions for individual loans, as well as be ready to provide motivation for the loan. Necessary preparations for personal loans include:

- First thing you should do is to outline main purpose of this loan, and what you are going to spend it on. There can be various options, they depend on your personal needs, whether it is a new vehicle or house renovation. These finances can also be used for health care or resort. When you are fine with all above, personal loan will be a great help to pay your crucial debts, in case you have any, thus increasing credit score.

- Make sure you figure out the precise period and the sum of money needed. Financial specialists recommend taking a loan only when you are in a real need of finances so that you manage to pay this credit off on time. The longer the loan terms are the bigger the amount of interests, so it is better to err on the side of caution and look into all the requirements that go with a certain loan.

- Make an appropriate arrangement for credit reimbursing: the installment sum can’t be in excess of 15 percent of your month to month income. You certainly need to precisely survey your money related troubles for the following time-frame and, in view of this, cautiously modify your month to month spending plan for convenient advance reimbursement. This methodology can prompt the noteworthy in general costs decrease.

Preparations for personal loans with no general requirements

Once you have applied for a loan, the financial specialist will ask you to fill in a corresponding form to give additional data about yourself. This is also necessary in order for them to determine the level of your eligibility for the credit. Furthermore, this process requires the identity of the borrower to be fully confirmed, that prevents any possible frauds and shady deals on both sides. For that reason they must provide driver’s license details and social security number data. As soon as a suitable loan specialist has been found, the amount of money you need will be transferred to your credit card. You will be pleasantly surprised with the simplicity of the whole process.

Is it worth it?

When you first consider it, the requirements for personal loan might actually seem quite challenging and unrealistic to fulfill. However, our frequent clients have quite the opposite thing to say about the company’s way of handling these operations. And if it’s not the foolproof evidence for the non-complexity of this process, then we don’t know what is. In fact, once you yourself follow all the steps and see for your own how easy it is, you might think that it’s too good to be true.

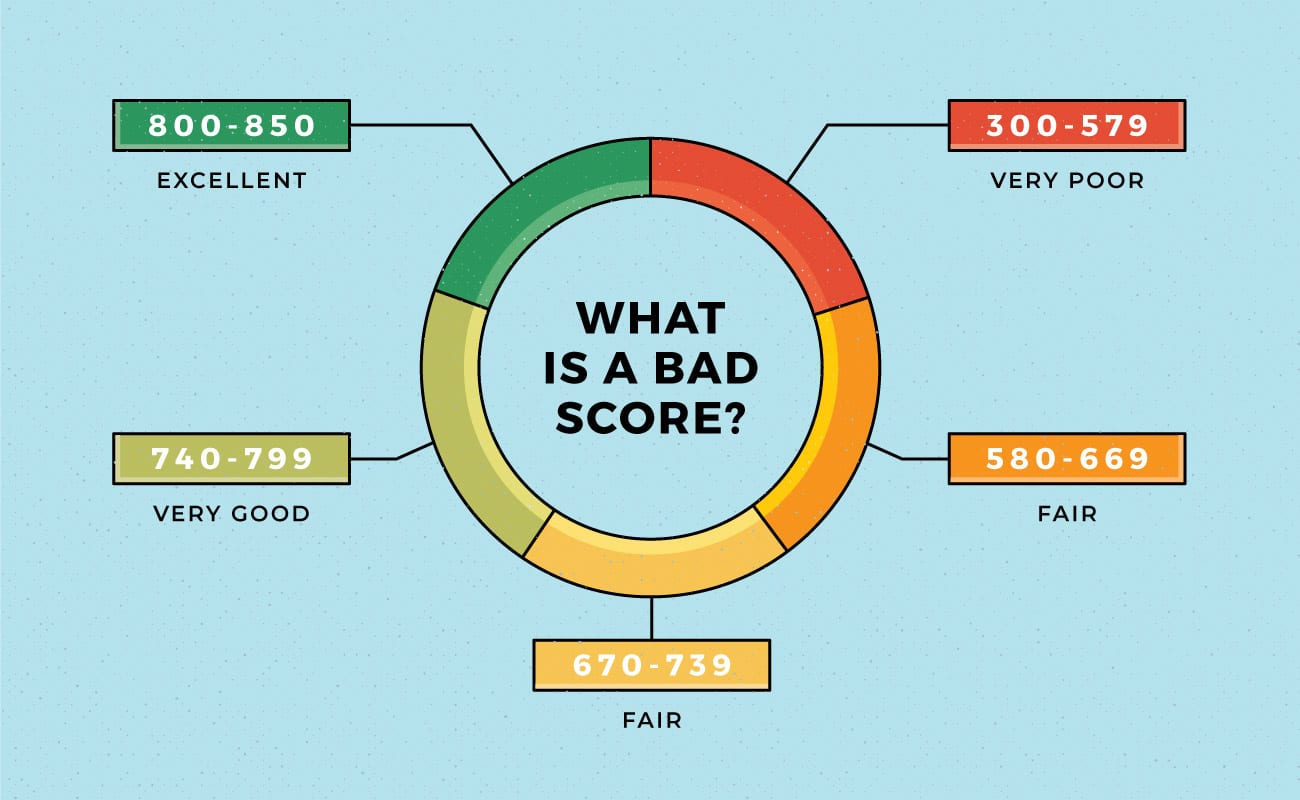

We are certainly aware of the fact that plenty of credit ratings in the US are bad or low at best. A large portion of the potential clients basically committed little past errors in dealing with their accounts, yet they are entirely dependable customers who have a decent month to month pay, which might be required for the appropriate credit reimbursement.

Advantages of personal loans

The opportunity of getting individual advances opens up for you an enormous number of preferences. For example, our organization encourages with getting advances to the individuals who have a bad record of loan repayment and couldn’t get an advance from different banks. Besides, we give an incredible chance to people with poor FICO scores to address the circumstance and improve their record of loan repayment. Despite the general misconception about preparations for personal loans, the whole application procedure is straightforward and as a rule takes close to a couple of minutes. The trustworthy loan specialists picked by us are quick to move cash to the private record given by you, in this manner giving you the genuine chance to rapidly tackle your monetary issues.

Online personal loans

In spite of your present FICO assessment, putting an application for an individual credit on the Internet makes it conceivable to satisfy this procedure as fast and advantageous as could be expected under the circumstances. In this way, the budgetary organization is occupied with giving quick and not convoluted wholes of cash that can be credited to your own record in only one business day.

For some clients, it’s not all that simple to get a little credit for a brief time-frame. What’s more this, individual credit conditions are unquestionably superior to anything any ideas for a payday advance.

Getting just little wholes of cash, you may diminish your regularly scheduled installments to the most reduced dimension and credit reimbursements won’t be an unthinkable errand and may take a brief period. An individual credit is an amazing chance to rapidly fix your current money related circumstance and remove to the social stepping stool. One of the useful preparations for personal loans is setting your advance application on the Internet. This way you will get enormous advantages contrasted with those clients who do it in the old route by visiting bank informal breakfast. Additionally, online credit gives an amazing chance to improve your present FICO assessment and as needs be get later on much better terms for a wide range of obtaining. What’s more, for those clients who as of now have a terrible record as a consumer, online credit can reestablish it.