Everything You Need to Know About a Variable Interest Rate

Even if you are only beginning to familiarize yourself with the world of finances, there is a chance you’re not a stranger to the notion variable interest rate. It is incredibly popular and quite handy in terms of banking products as it is accessible on just about any type of them conceivable.

A variable percentage, a floating or adjustable interest rate whatever you want to call it, this notion can be basically summarized as a debt or loan that does not have fixed rates. As simple as that. It is essential to know the terms and conditions of variable rate inside out before going for another credit card or borrowing.

The point is, it is centered around a benchmark interest rate, also called index. The changes in the index and percentage rate are interdependent, that is to say when the former undergoes any changes, the latter will do so as well.

What are the pros and cons?

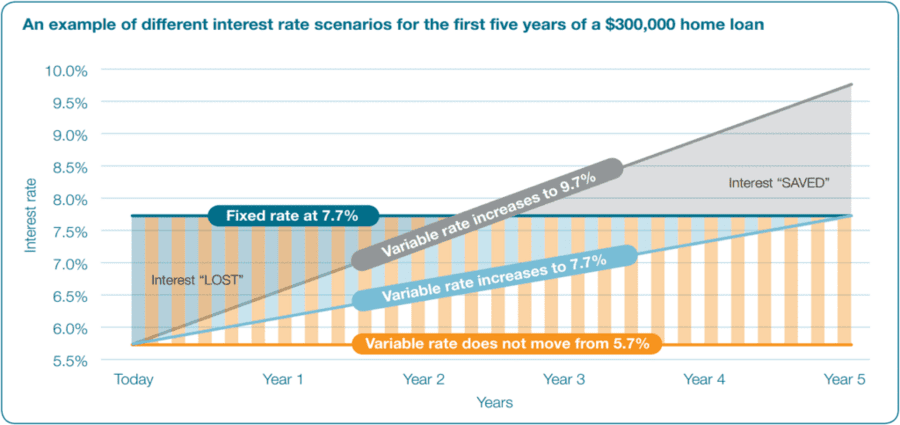

A variable loan rate has one indisputable advantage, which is that if the underlying index decreases, the interest payments of a borrower also drop. But you should bear in mind that it works like that the opposite way, if the underlying index rises, payments rates also rise.

However variable percentage doesn’t provide stability that the other option, fixed interest rate, does, but it is commonly countervailed by the expanding of pliability in such aspects as additional charges and fees. This feature comes to the aid especially in situations like taking on a home loan or a car loan, because when it comes to the way and time of your reimbursement, this additional flexibility can largely influence the amount of percentage you have to pay.

You may expect the interest rate to stay where it originally was when you get a new loan or credit card. However, that’s not always the case. No matter how you slice it, sometimes variable interest rates can have a tricky effect on your budgeting. As a result, you might earn or pay a various amount every month. Moreover, if an interest rate goes up, you may pay off a little more than expected.

When exactly is a variable interest rate used?

There are financial instruments and investments that allow for a variable interest rate, which means that when you borrow a certain amount of money, the interest that you’re charged om it can go through periodic changes.

A lot of financial products normally presuppose variable interest rates, particularly the following:

- Credit cards

- Car loans

- Student loans

- Mortgages with floating rate

The underlying reference rate or a variable interest rate index is affected by the nature of security or loan. A certain type of benchmark rate, for instance the country’s prime lending rate, can take on the role of the foundation for adjustable interest rates for credit cards, mortgages and cars. Financial and banking establishments collect a benchmark rate margin from their customers, and this margin is affected by particular aspects, including the asset type and the credit score of a consumer.

As a consequence of essential index changing (for example, the aforementioned prime lending rate), lenders are entitled to alter their variable rates. To put it simply, your lender can cause your interest rate to change whenever the index that your variable interest rate is tied to changes. And in that case, your regular payment can subsequently increase or decrease.

However, a variable interest rate is not necessarily applied to every single type of loan out there. A loan is not liable to the same index rate alterations provided its interest rate is fixed.

It can be risky to take a loan that has a variable interest rate, but in certain situations it can turn out to be much more beneficial than a loan with a fixed rate. To find out what they are, keep reading our guide.

How often does a variable interest rate change?

Changes in interest rates may be influenced by the terms of your funding and the key interest rate used by your creditor. For instance, credit cards are usually tied to the main set of the Wall Street Journal in the United States, the base rate for corporate loans given by at least 70% of the top 10 US banks.

The amount of rate changes you are liable to can vary greatly, including student loans, that change periodically; credit cards, that change simultaneously with alterations in Federal Reserves, and that can occur several times a year; mortgages with floating rate that only stay the same for the initial couple of years, and then undergo regular changes.

Can I be informed on my rate changing?

The Law “On The Truth in Lending Business” is designed to make sure that you receive information about your interest rates before you take out a loan. Because of the truth about credit law, lenders must disclose your APR and indicate whether they are variable or fixed when you apply for a mortgage loan or a car loan.

For some loans, you will also receive a message before the change in interest rates takes effect. For example, for a fixed-rate mortgage, your lender must notify you at least seven months before the first increase in your mortgage payment. After that, you will be notified two to four months before each change if this change affects your monthly payment.

Under the Law on the Realization of Lending, lenders must provide you with information about your annual percentage rate of charge and whether they are variable or fixed before you open a credit card.

Credit card issuers do not have to notify you when your variable interest rate changes, but some do so voluntarily.

Who is a variable interest rate suitable for?

The potential investment funds related with a variable loan fee is absolutely alluring yet there are two unmistakable threats to know about. In the first place, there’s the likelihood that your installment could significantly increment if your rate were to go up. A hop of a few hundred dollars in your regularly scheduled installments may leave your business extended thin fiscally in case you’re ill-equipped.

The other entanglement is the danger of paying more in enthusiasm on what you get if your rate were to increment. The more drawn out your credit term, the more prominent the chances of a variable rate ascending sooner or later. On the off chance that the rate stays higher, the expense of getting is probably going to surpass that of a settled rate credit.

A variable interest rate might be an appropriate decision for entrepreneurs who are obtaining littler sums and are in a situation to pay the credit off moderately rapidly. This sort of rate is likewise better for organizations that have a relentless stream of money coming in every month, which would improve them ready to alter if a rate change results in a higher installment.

On the off chance that you have a more current business that is as yet increase, a critical increment in your regularly scheduled installment could be hazardous for your financial plan. Picking a settled rate advance that has a similar installment every month might be increasingly best.

When is best to use a variable rate?

If you have still decided to deal with variable interest rate, there are a couple of risks you should take into consideration. Increasing your debt on a monthly, quarterly, or even yearly basis can make budget compliance difficult. In some cases, however, a variable rate may be right for you.

Credit cards with variable interest rate

There are plenty of credit card APR that are not fixed, so you may only get one variable rate card. However, unlike loans, you can usually avoid paying interest on purchases made with a credit card by fully paying off the balance every month or during the introductory phase of 0%.

If you have a balance on a variable rate card, you may be charged more interest than you expect.

If the index linked to your interest rate rises, your credit card issuer may decide to apply this increase to existing credit. Many credit card companies charge a higher percentage for the entire billing cycle, even if the index has not risen until the end of the cycle.

Loans with variable interest rate

Interest rates on loans with a floating rate may fall as indexes fall, but variable interest rate are not always suitable. Some even limit how much your interest may decrease.

However, under the right circumstances, a variable rate loan may be cheaper than a fixed rate loan.

This is due to the fact that the variable interest rate may be lower than for loans with a fixed rate, and may increase over time. For a variable rate mortgage with an initial fixed interest, if you know that you are going to rent out a house or sell it before interest rates increase significantly, a variable rate can save you money.

However, if you stay at home after the deadline, your payments can go up significantly. This can make it difficult to establish a balance and, ultimately, reverse mortgage.

Make sure that you are ready to raise the interest rate and monthly payments before using the new floating rate financing, be it a credit card or a mortgage. When you are ready, you can see if your budget can handle the worst case scenario.