The Features Of Lending For People With Disabilities

The need for supplementary financing is relevant for all of us, irrespective of our welfare and health. Almost 20% of Americans have incapacitates of different severity. Of course, this makes their life much more complicated. Therefore, many home-folks with handicapped persons need credits.

Public programs

There are a few public programs in American to provide lending for people with disabilities. Such programs are SSDI, BA, and SSI. SSDI is a social security disability insurance for handicapped. SSI stands for Supplemental Security Insurance, which helps disabled people over 65 who have low earnings. VA means the Veterans Administration, which supports veterans with impaired functionality.

For additional information on state financing programs, visit “Disabled World and Gov Loans.” Moreover, each of the states has the Virtual CIL or Center for Independent Living.

There are various kinds of loans, there are also lots of nuances which should be taken into accout. To discover which kind of loan is the most appropriate for people with disabilities is difficult, while an error can cause monetary implications.

To do this, we encourage you to examine our article devoted to the loans for disabled persons.

Meaning of a loan

A loan is an act of giving money or other objects possessions for a specific period, after which the debtor must pay off his/her debt and an interest rate. Lending for people with disabilities can be provided by different financial agencies, the authorities, and private persons. Loans make it possible to boost the financial system of the country and permit the clients to buy different products and services.

How to obtain credit?

In order to obtain credit, you have to comply with the requisitions of the debtors. Usually, these can be minimum standards, like being of age, living in America, opening an account in one of the American banks, and having a source of regular income.

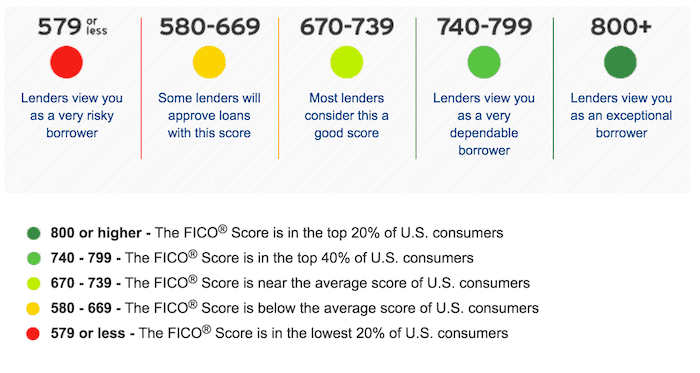

You can see your credit history by soliciting an information from one of the American credit bureaus. It is accessible cost-free once a year. Additional requests will be paid. If your credit history is at least 630 points, your loan will be definitely approved.

The significant point to consider before requesting a loan is your credit history. This factor will influence the decision of the creditor to give you credit and the conditions for its granting. If you comply with these minimum standards, most creditors will be willing to consider the possibility of extending credit to you, irrespective of whether you are a disabled or a healthy individual.

There are secured or unsecured loans.

With the first type, an obligor gives a creditor his/her own precious commodity as collateral for the leverage. If the obligor fails to pay off the loan, the creditor can use safety for the compensation of the cost.

Avoid applying for payday loans

With the common payday loans, you may get an endless cycle of prolongations with increasing interest rates. You may wish to get a rapid loan to solve the issue when getting into extreme monetary circumstances. Handicapped citizens usually have harsh conditions, which can make it hard to pay off a loan. However, you can concern for concessional conditions from other creditors as a disabled person.

How to get and repay a loan?

When drawing up the contract, the parties undertake to comply with the rules of the document: the bank will provide money to the borrower, and the borrower will pay the loan regularly throughout the entire term, including the commission. It would seem that this is obvious, but many try to put out small loans first in order to pay off at least a part. In this case, you overpay the interest for the service, so that the total amount is more.

Study loans for disabled

There are certain kinds of loans that permit disabled individuals to make them less dependent on other people’s support (such as a particular rehab to enhanced mobility of the handicapped people).

Mortgage loans

The Nar presents data about credit loans for individuals with disabilities with lower interests. Banks and other creditors can’t refuse you a credit for the cause of your disability.

Service loans

This type of crediting allows disabled people to hire employees who will help them around the house.

Business loans

If you’re going to start a business to reduce your dependence, please consult the Small Business Administration (SBA) to support your commerce in order to secure individual economic activity.

Will a loan influence state benefits?

Obtaining a lending for people with disabilities can influence the benefits you receive from the state. If you obtain help from one of the principal programs listed above, you can lose or cut benefits. In certain circumstances, you’ll be obliged to submit declarations for a loan, taken as one of your assets.

Choose your loan

We provided you with necessary options about lending for people with disabilities, and now you can choose the most suitable option and make an application.

You should request a loan on our page to obtain special propositions from various creditors. If you find it hard to choose a loan, feel free to ask as for help. Our specialists will give you a bit of good advice.

I’m disable