How You Can Minimize Investment Taxes, Reduce The Loss Of Profits

Taxes in the United States have many nuances that are often difficult to understand without occupational accountant. But with an understanding of the basics you can minimize investment taxes. In addition, tax rates change from time to time. The US Internal Revenue Service updates the information provided on its website, but it is not the only organization that taxes citizens’ incomes. Each US state may charge additional tax charges that you should be aware of.

Every tax you save will help you invest more next time. To understand how not to pay taxes more than possible, you will require to reckon for all the circumstances as a particular taxpayer, because it will depend on what taxes you will have to pay and what rate will apply.

Keep reinvestment records to avoid double payment

If decided to automatically reinvest the profits from your previous investments, you can make a tax deduction from the reinvested dividends. You will pay for the profit from the dividends got for the first time, and the subsequent investment of these funds should be indicated in the tax return as an expense on the down payment. This will help will aid you not to do a twice payment for the profit twice for the profit. Save all reports on your dividends and reinvestments and leave them at least until the end of the tax period.

Mutual investment funds

Professional capital management attracts a lot of investors in mutual funds. These funds also provide, as a rule, the diversification of your investments. Do not forget also that investments in common funds are often taxed. There are specific taxes that apply to investing in mutual funds.

Taxable distribution

You must independently monitor the distribution taxed, because mutual funds pay taxes on their own behalf, and you are responsible for your tax obligations separately. Mutual fund management must provide you with a form 1099-DIV. There are all deductions from the fund.

Dividends

In event you getting the dividends, only certain securities, such as municipal bond funds, are not subject to taxation due to your payment from a mutual fund. Even this happen, you may not be exempt from federal tax and tax on personal income.

In most other cases, the tax rate can be up to 15% of the profit, from which the capital management expenses of the fund are deducted. Also, in case of reinvesting your dividends into a mutual fund, the tax will not be canceled. Always find out before investing about dividend payout conditions to minimize investment taxes.

Capital gain distribution

The allocation of capital growth is subject to taxation, as a mutual fund makes securities transactions on your behalf as a shareholder. If this is a durable contribution your funds, dividends will be taxed at the maximum tax rate.

Capital gains from the sale of mutual fund units

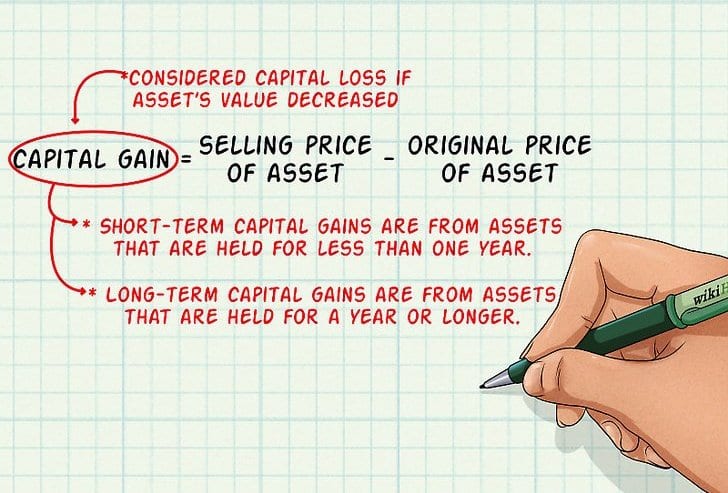

As a shareholder of a mutual fund, you can make transactions with shares of the mutual fund itself. If the difference between buying and selling shares of the fund is positive, then accordingly the taxation law you will be obliged to pay as for capital gains. Calculate capital gains using several proven methods for this, and if it can be difficult for you, use the services of a professional accountant. This will help you minimize investment taxes. Also, remember that capital gains on long-term and short-term investments are taxed at different rates.

Taxes for stocks

Stocks offer more control options to minimize investment taxes. You can choose certain stocks, accelerate or, on the contrary, slow down the sale of stocks, trade them through a preferential account or deduct a tax loss in different reporting periods.

Dividend distribution

The distribution of dividends paid by companies is taken into account by the Internal Revenue Service as your income. Most often this happens once a quarter. Qualified dividends are taxed at the maximum rate, as opposed to unqualified. This happens regardless of whether you reinvest dividends or take them back.

Long-term capital gains

If you own shares for more than one year, then if you sell them with a profit, the income will be considered a long-term capital gain. As with the distribution of dividends, this type of profit will be taxed at the maximum rate.

Calculation of profit and loss

When selling shares, it is considered that you receive income if the price at which you sell them is higher than the price for which you purchased them. However, it is necessary to deduct from the difference between the sales and purchase price also all the attached fees and charges. If after all deductions from the difference you get a negative number, then this number is deducted from the capital gains tax. Proper accounting of your profit will help you minimize investment taxes for earnings per share.

Bonds

The interest income on bonds is subject to ordinary tax rates on incomes of US citizens. US Treasury bonds and promissory notes that bring you income are not taxable. At the same time, if you are a resident of the state that issued municipal bonds, in most cases the income from many of them is not subject to local and federal taxation.

Capital gains on bonds

Like all securities, bonds are subject to fluctuations in their value, so you have a chance to make a profit on the sale of bonds, in addition to earnings on interest. By selling bonds you can expect that the income from this operation will be subject to capital gains tax. As well as selling shares, capital gains on long-term bonds that you hold for more than a year will be taxed at a maximum rate of 15%.

So, now understanding the basics of taxation of income from securities, you will be able to minimize investment taxes that you will have to pay upon tax time. For more information on types of taxes and tax rates, you can find on the website of the internal revenue service.

thanx, guys! But what if I want to minimize taxes, but it takes so much time and effort that I decided to let it go as it goes. Need more help with this

Dear Albert, we are ready to help. You just need to send us a message with your question. Have a good day