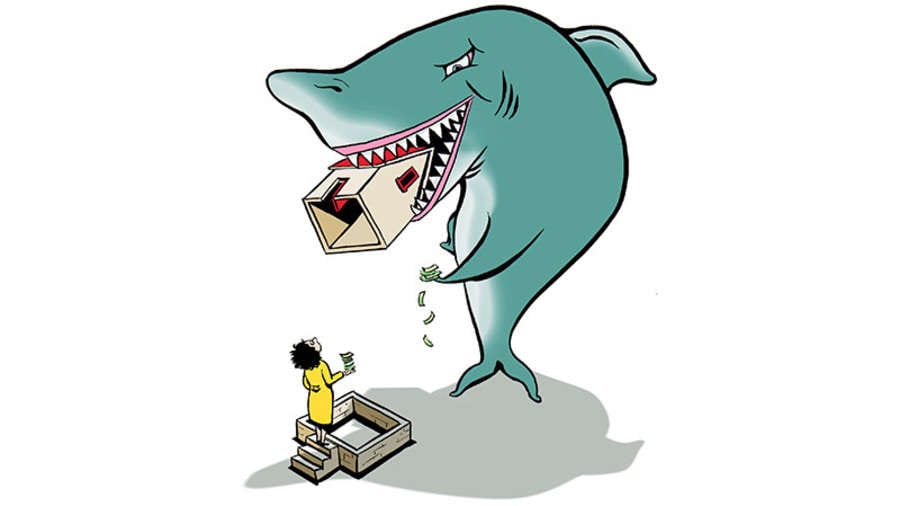

What Are Payday Loans Terms And Can It Take You To Court?

People can consider paying the loans is something simple and easy but it’s not true in fact. That is why many people are worrying if payday loans terms can take them to court. In short – yes. But the situation can change dramatically, so you must be aware of the laws around collections. But in order to be truly prepared, you have to know what to expect.

Here we collected useful tips on how to act if you default on your payday loans terms:

PAYDAY LOANS TERMS

Instant loans are small, high-interest personal loans that are paid out when you get your next paycheck. When you take such a loan, you agree to certain conditions. To get an instant loan, you need to have a proven place of work and a verified account in good condition. You must also provide photographs for identification. Typical conditions allow lenders to withhold a borrower’s salary to collect a one-time payment, which includes interest, over the next payment cycle.

At the end of the agreed period of time, the lender will charge for the payday, drawing the loan amount plus interest from the account. If a transaction cannot be executed for an agreed amount, the loan usually goes into default.

STEPS IN THE COLLECTION PROCESS

The default loan initiates a general collection process for lenders who want to pay off debt. This process may include bank withdrawal attempt, collections, opportunities to be proactive, the possibility of filing a criminal court (which is highly unlikely), potential lawsuit (which is more likely).

So if you have an unpaid payday loan, here are the possible actions:

STEP 1: BANK WITHDRAW ATTEMPT

Payday loan lenders may withdraw automatic debits from a borrower checking to collect a loan. They begin by initiating a single debit for the total amount. If this doesn’t work, they will dissolve the amount of debt into smaller debts in order to get what they can. If the account is low or overvalued, each of these transactions may cause fees.

STEP 2: COLLECTIONS

According to the law, lenders can use collection agency as a mediator between the lender (or its representatives) and the borrower. The agency can make calls or send letters. Collectors can’t give the details about the debt to friends and relatives used as a reference. However, they may ask of the borrower’s location. You should always strive to talk in collection agencies to agree on your debt and make payments whenever you can.

STEP 3: BE ACTIVE

Be active in negotiating your debts. It is more profitable for a lender to work with you in collections. If a person files for bankruptcy, there’s nothing for lenders to collect. If you feel pressure, tell collectors: “I am thinking about filing for bankruptcy.” It’ll benefit the negotiation process.

STEP: 4 POTENTIAL CRIMINAL COURT

Lenders can’t take you to the criminal court, but this doesn’t prevent them from declaring that they can and try or even speak of imprisonment, or a court order, erroneously approved. This can make the life of the borrower more difficult, since consideration of the court’s application requires compliance with the law.

STEP 5: LAWSUIT

Remember that lenders can summon you as the defendant in a civil lawsuit.

WORK WITH COLLECTORS

If your financial situation is rather poor and debt collectors often call you, you may feel depressed and refuse to talk to them. If you are going to clear your debt and recover your credit, it’s not your option. Here are some of the best practices to ease repression and reduce total debt:

Cease And Desist Letter

Never you send a letter of cease and desist letter on your behalf or through a lawyer, even if you fell scared and depressed. It’ll ruin any chances of a relationship between a collection agency, a lender and a borrower and trigger a lawsuit. You’re better off just answering the phone.

Conversation Management

To get a good basis at an early stage of the negotiation process, monitor the conversation by asking the right questions. Don’t be distracted by answering questions and requirements of the bill collector. Instead, calmly and affirmatively ask them for their name, company, direct telephone number and the reason for the call.

Be Honest

When you talk to collectors, be honest about your financial situation and solvency. If it makes sense for your financial situation, indicate that you would like to avoid bankruptcy, which should give you additional bargaining power.

Say That Friends And Family Are Out Of Limits

If a collector encourages your friends and family to find you, ask them to stop these collection attempts. If they refuse, document all the attempts of the collectors to contact with friends and family to create a lawsuit against collectors.

HOW TO AVOID COURT

To avoid court, the borrower must negotiate with creditors. In addition to negotiating with creditors, here are some of the best practices for taking on your outstanding debts on debt money:

Household Budget

Proactively organize your family expenses, like bills to pay, and when there is a strategy to knock it out. Use a spreadsheet or any mobile app to plan your expenses.

Get Your Priorities Straight

Save your payday at the top of your priority list to avoid court. Prioritize your daily bills. Try to sort them out as soon as possible.

Keep In Touch With The Lender

It is always helpful to avoid collector if you want to avoid legal problems, and you can do it by keeping in touch with your lender and frankly telling him about your measures or actions taken. Let your lender know what is happening will help you to get an extension before your credit defaults.

Make More Money

This may be easier said than done, but if you think you may be in a bad financial situation to pay off your loan, look for opportunities to earn extra money. Regardless of whether you are doing casual assignments for the weekend or doing freelancers on the Internet, look for ways to get money before the date of your loan.

LEGAL LOOPHOLES

Although debt collectors cannot legally threaten criminal prosecution of a borrower, there are several loopholes that make this possible:

- Debtors may be arrested for the missing court. In some states you could be arrested if you missed the court date, no matter if you didn’t understand that you had it, or you thought it was frivolous.

- Debtors can be arrested for check fraud, especially if you bounce checks to creditors.

- Debtors may be arrested for failure to pay for or return the goods: in a lease-related situation, this may be the reason for the arrest.

Debtors should know the payday loans terms of their states when it comes to debt. To avoid being wrapped in a potentially expensive, time-consuming lawsuit it’s recommended that those who default payday loans terms decide on debt with lender and not the collectors.